Every Indian family has that one story.

Maybe it surfaces during a wedding or a festival gathering. Someone brings up a plot of land in a distant village that your grandfather once bought. There are memories tied to it.. visits during childhood summers, tales of boundary walls that were never built or mango trees that once marked the edge. Eventually, someone decides to go see it.

And the land is there, real and tangible! But trying to do anything with it – sell it, build on it, or take a loan against it, becomes a complicated and slow process. The registry says one thing, the revenue department another. Old tenants claim rights. Neighbours hint at an old case still dragging on in court. The land exists, but ownership is fuzzy, contested, or simply not worth the hassle.

This is a familiar experience for millions of Indians. What if land didn’t have to be like this? What if it were as simple and accessible as owning a stock? What if it’s verifiable with a click and usable anywhere in the country or the world? That’s the promise that land tokenization offers. It’s a $3.3 trillion opportunity waiting to be unlocked in India.

Understanding the Complexities of India’s Land Ecosystem

India’s land governance system operates in what experts call a “departmental archipelago”, a cluster of disconnected islands of authority. Records come to be fragmented across multiple departments: cadastral maps in survey offices, ownership rights with revenue departments, sale deeds in registries, and property taxes maintained by municipalities2. Rarely do these datasets align. Often, they contradict one another.

The result is a lack of conclusive titles. This uncertainty can cause widespread disputes. Nearly two-thirds of all civil cases in Indian courts are related to land. The average time to resolve one? Fifteen years3. The economic cost of this inefficiency is staggering… an estimated 1.5% of GDP4 can be boosted simply through land record digitalization in India.

India ranks 154th globally in the World Bank’s Ease of Doing Business index for registering property. On average, it takes 58 days to complete a property registration here, compared to just 3 days in countries like Australia. Land dispute resolution is ranked at 136th globally, with an average resolution time of 1445 days versus the global average of 358 days.

What It Means for Households, Lenders, and Investors

This broken system impacts a wide swathe of the economy and society.

For everyday Indians, land is seen more as a liability than an asset. India has one of the smallest housing industries globally. Only 12% of Indians have outstanding mortgages6. In comparison, this figure is over 3X higher in major developed countries. Gold is a more popular investment among households because it’s simpler to buy, sell, and use as collateral. Land remains underutilized even though it is potentially more productive.

For NRIs and international investors, the constraint are even more daunting. Different states have different rules. Transactions often require physical presence or notarized power of attorney arrangements. The lack of transparent records and a high risk of title fraud only worsen the risk perception for international capital.

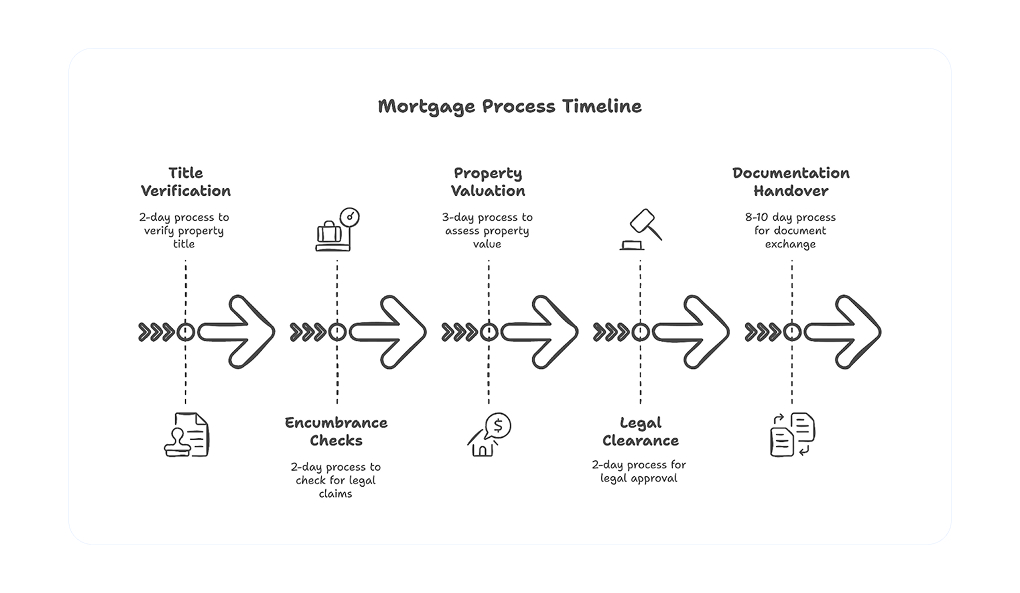

Even lenders suffer. A typical mortgage process in India takes up to three weeks, involving multiple layers of manual verification. This includes title checks, encumbrance certificates, property valuation, legal clearance, and physical document collection. Manual verification and fragmented systems increase lending costs by approximately 1.5%.

As Ajit Menon, COO of Vivriti Group, aptly put it: “The dichotomy of the Indian Financial Ecosystem is that the same retail customer who gets INR 5 lakh personal loan in 10 minutes will have to wait 3 weeks to get a INR 20 lakh Home loan”.

Land Tokenization : The Great Unlock

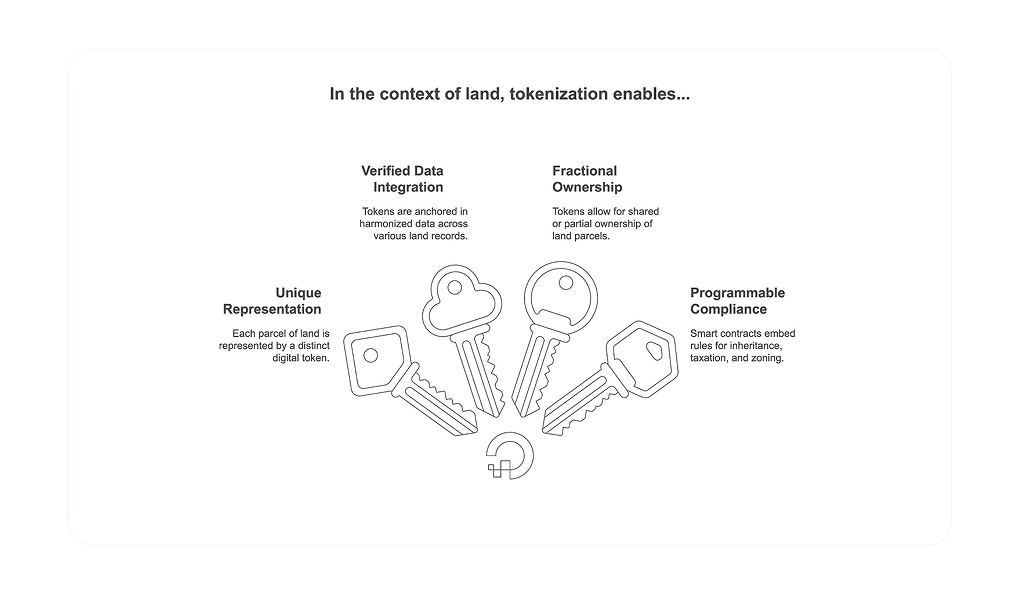

At its core, land tokenization convert rights associated with real estate and property into tokens recorded on an immutable ledger. These tokens are not just digital certificates. They carry with them the entire state of the asset right, ownership history, legal rights, restrictions and realtime updates. Think of it as moving land from a paper-based system full of silos and manual processes into a digitally native environment where the asset is not just represented, but can be interacted with, transacted on and trusted programmatically. With tokenization, land assets can become verifiable at the click of a button. A plot can be divided into fractional units and transferred.

However, it is important to make the distinction that tokenization of land is not merely about financialization. While it can enable capital formation, enable investment access and offer easier collateralization, its deeper promise lies in how it transforms the way property rights are recorded, managed, and executed. Land tokens can include as set of verifiable credentials or digital proofs issued by trusted entities such as title registrars, valuers, local authorities, and banks. Through programmable logic, it becomes possible to automate inheritance transfers, streamline lease agreements, resolve disputes, and ensure compliance – directly at the token level.

By reducing ambiguity by creating verifiable credentials for the asset itself, tokenization empowers citizens, institutions, and governments alike. Land records no longer have to rely on disconnected paper trails or multiple databases. Each token carries a real-time, tamper-proof record of ownership, rights and restrictions. This clarity reduces disputes, lowers transaction risks, and increases confidence across the ecosystem. For citizens, it means the ability to prove ownership without navigating opaque bureaucratic processes. For institutions, it unlocks faster, safer workflows (ex. registering property changes). For governments, it enables transparent, auditable systems that reduce fraud, improve service delivery and build trust. In that sense, tokenization makes land not just investable, but truly usable.

Economy Level Impact: A $3.3 Trillion Opportunity

Tokenizing land can potentially unlock one of India’s most dormant asset. According to estimates, the value of underutilized capital in land holdings in India exceeds $1 trillion. By enabling trust, verifiability and liquidity through tokenization, this capital can finally enter productive circulation. It can serve as a powerful catalyst for India’s journey toward becoming a $10 trillion economy.

Key macroeconomic outcomes can include:

MSME Growth: With clear titles and collateralizable assets, small businesses could potentially add over $1 trillion within just three years and boost employment at the grassroots level.

Increased Market Participation: Tokenization simplifies property transactions by reducing legal and operational friction, which can significantly lower transaction costs. More accessible models like fractional ownership can meaningfully expand market participation by allowing a wider range of entities to engage with land as an asset.

Process Modernization: Land registration timelines could shrink from weeks to under 7 days, bringing India on par with some developed economies and making real estate transactions as seamless as e-commerce checkouts potentially.

Participant Level Impact: Empowering Citizens, FIs and Global Investors

While the macro shifts are significant, the real change lies is in the daily experience of stakeholders whose interactions with land become radically simplified and productive.

For Citizens

Access to Credit: Mortgage penetration currently around 12% could grow up to 4x, unlocking formal credit for millions. Approval timelines could fall from 21 days to just 1!

Financial Inclusion: The bottom 40% of households – often excluded from formal credit could gain conclusive digital titles, enabling them to access institutional loans with reasonable interest rates instead of turning to informal lenders.

Cultural Shift: As trust increases and utility improves, land could emerge as a preferred investment class even in rural households, gradually shifting preference from gold.

For NRIs and Cross-Border Investors

Fractional Ownership: High value properties can now be accessed in smaller, affordable shares. This opens doors for retail participation and global diaspora engagement.

Fraud Reduction: Immutable land ledgers could cut down title fraud by up to 40%8 and restore trust in Indian land markets.

Streamlined Compliance: Smart contracts can automate functions like regulatory checks and ownership transfer protocols, reducing friction for cross-border transactions.

For Financial Institutions

Reduced Risk in Credit Underwriting: Tokenized titles enable automated credential verification, reducing reliance on slow error-prone manual checks. Smart contracts can also allow for better credit decisions.

Faster Loan Disbursements: End to end digitization can reduce loan disbursal time from three weeks to under 24 hours.

Financial Innovations: A formal, digital land economy sets the stage for new instruments like fractional mortgages, rural REITs and land-backed digital securities paving the way for a vibrant fintech ecosystem.

The true potential of land tokenization lies in the diverse ecosystem it can enable, far beyond just financialization. By embedding rights, logic, and compliance directly into digital tokens, it opens up new possibilities for how different stakeholders can engage with land. For instance, innovative startups can build not only investment platforms, but also tools for co-ownership management, land leasing, or automated dispute resolution based on programmable rights. Entrepreneurs can unlock value from tokenized land not just by selling, but by leveraging rights such as leasing or fractional utility in flexible, programmable ways. Governments too can modernize land administration with real-time registries that reflect not just ownership, but also usage rights, liens and transfers. All this verifiable and auditable through tokens. These capabilities could also extend to managing commons and community lands, enabling transparent and participatory governance.

Global Lessons that can shape India’s approach

We already see this in practice. The UK’s HM Land Registry is digitising its land records, aiming to automate 70% of updates by 2025. In pilot trials, a blockchain-based transaction took less than 10 minute, a process that normally takes weeks9. By using Title Tokens and programmable compliance, the UK is showing how property transfers can become faster, more transparent, and fraud-resistant.

Look at developing countries, Economist Hernando de Soto’s seminal work in Peru underscores the transformative power of formal land titles. Between 1992 and 2004, Peru issued over 920,000 land titles to informal property holders. The results were profound – a 17% increase in work hours and a 28% drop in child labor10. When people have secure ownership, they invest, build, and grow.

Finternet: Unlocking Tokenization’s True Potential at Scale

Tokenization is a powerful concept but to make it work at scale, across jurisdictions, stakeholders and systems, we need a shared foundation. This is what the Finternet can provide; an interoperable and interconnected financial framework that allows assets like land to move, evolve and operate in a programmable and compliant manner. Instead of simply digitizing land records the Finternet enables a transformation of how land is owned, verified, transacted and integrated into broader financial systems.

By providing a programmable, verifiable layer for both value and rights, the Finternet can enable land tokens to carry more than price, they can carry legal meaning. This is essential for ensuring that land tokenization goes beyond capital markets to become an infrastructure for enforceable, compliant, and dynamic property rights.

Finternet powers land tokenization at scale by addressing both the technical fragmentation and institutional complexity that have long hindered property innovation in India. It begins by enabling standardized asset representation, allowing land records from different departments and states to be harmonized into a standard token format. This directly tackles the aforementioned ‘departmental archipelago’ challenge and creates a unified digital representation of land across jurisdictions. Each land token on the Finternet is programmable and capable of embedding rules related to zoning, taxation, inheritance and compliance directly into its logic. This ensures that transactions are not just faster but also legally and regulatory compliant by design. Moreover, Finternet is interoperable by design connecting state land systems, registries, financial institutions, property platforms etc. through open APIs and modular plug ins. This means states and institutions can adopt tokenization progressively without needing to overhaul their existing infrastructure based on use cases they want to prioritize. The networked architecture also ensures that a land token isn’t stuck inside one system but it can move, interact and scale. It creates the conditions for composability, where land tokens can be bundled with for instance insurance, credit or infrastructure financing into entirely new kinds of financial products. And because every actor be it state governments, financial institutions, fintechs or investors are operating on interoperable rails, trust and efficiency are built into the system by design.

Together, these capabilities make Finternet much more than a transport layer for digital assets. It becomes the operating layer for a programmable land economy, turning land tokenization from a useful concept into a scalable reality.

The Next Chapter for India’s Land Economy

The story of India’s land is one of dormant potential – assets that exist on paper but not in practice, inherited wealth that can’t be used, and value that doesn’t flow. Tokenization gives us a way to change that. But tokenization alone is not enough. Without shared infrastructure, its utility can remain siloed and limited. This is where the vision of the Finternet matters as a framework for interconnecting multiple ecosystems that allow tokenized land to move freely across registries, lenders, innovators and marketplaces. It is through this architecture that tokenized land can reach its full potential that is accessible to citizens, useful to institutions and composable as an asset. By making land tokens legally enforceable and programmable and rights-aware, we’re not just enabling its financialization but we’re creating a system where ownership can be easily verified, shared, transferred or inherited. It’s a step toward easier, more streamlined approach to land access, ownership and usage.

This blog has been Co-authored by Siddharth Shetty (Co-creator, The Finternet Lab) and Sanmesh Kalyanpur (Contributor, The Finternet Lab)

The authors would like to thank the individuals and experts who contributed insights, quotes, and feedback during the development and review of this piece.

Editorial and writing support from Vinith Kurian (Scaling Trust)